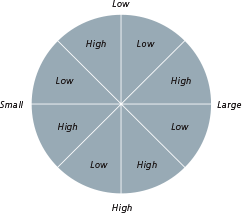

Every VIA IV portfolio is designed and diversified to minimize volatility and provide overall risk-adjusted returns superior to investment in any single asset class. Public equity markets are very efficient: they are unpredictable over the short term, but steadily increase in predictability over time. Risk and return are related. Thus broad global diversification, along with balanced asset allocation, determines the success of an investment model. Historical benchmarks show that: 1) index-managed returns consistently exceed the results of “stock picking” over time; 2) small cap equities offer higher expected returns than large cap equities; and 3) “value” equities provide expected returns superior to growth stocks. Different asset classes perform differently at different times – exactly which classes, and when, cannot be predicted. Diversification therefore is essential. One must be invested at all times to participate fully in market returns.

Market

Historically, equities trump bonds, cash and every other investment vehicle.

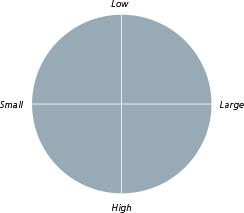

Size

VIA IV offers investors diversified, cost-efficient access to small companies. Historically US small stocks outperform US large equities.

Value

Research shows that market, company size, and relative stock price drive returns. Historically value stocks outperform growth stocks.